Discover everything you need to know about Columbiana County, Ohio, with the trusted oversight of Auditor Nancy Milliken. Located in the northeastern region of Ohio, Columbiana County spans over 535 square miles and is home to two cities, ten villages, and 18 townships. As of 2024, the county’s population has reached 99,823 residents, making it a vibrant and steadily growing community. With 76,427 registered parcels, the Auditor’s office plays a key role in maintaining accurate property records, delivering fair assessments, and ensuring transparency for taxpayers. Whether you’re a homeowner, investor, or new resident, our website makes it easy to access essential property information and stay informed about county services.

About the Auditor

Nancy Milliken, the Columbiana County Auditor, is dedicated to delivering accurate, transparent, and reliable public service for all county residents. With a strong commitment to fairness, she oversees property assessments, maintains financial records, and ensures that tax dollars are used responsibly. Under her leadership, the Auditor’s office manages more than 76,000 registered parcels, providing up to date property data and support to homeowners, businesses, and community members. Nancy Milliken’s mission is to protect taxpayer interests, maintain trust in local government, and offer accessible services that help residents make informed decisions about their property and county resources.

Columbiana County Auditor Roles and Responsibilities

The Columbiana County Auditor plays a crucial role in county governance, overseeing property valuation, tax calculation, and record maintenance. The Auditor distributes tax revenue, manages financial operations, issues various licenses, ensures public access to records, and maintains GIS mapping for parcels. Additionally, the Auditor audits county departments and fulfills statutory duties, including property reappraisals, tax exemptions, and enforcement of construction reporting, ensuring transparency, compliance, and efficient administration throughout the county.

Property Valuation and Taxation

The Auditor assesses all real estate and personal property, ensures fair valuations, and calculates property taxes for local government and public services.

Maintaining Property Records

The Auditor maintains ownership records, parcel maps, property transfers, and updates on new constructions or demolitions.

Distributing Tax Revenue

The Auditor ensures collected property taxes are distributed appropriately to schools, townships, municipalities, libraries, and other county services.

Financial Oversight

The Auditor manages payroll, accounting, budget compliance, and prepares financial reports to maintain transparency and accountability.

Licensing

The Auditor issues various licenses, including dog licenses, vendor licenses, and cigarette licenses, ensuring compliance with county regulations.

Public Records and Transparency

The Auditor provides access to property and financial records to the public, promoting accountability and legal compliance.

GIS / Property Mapping

The Auditor manages GIS mapping for land parcels, property boundaries, zoning, and related geographic data to aid planning and taxation.

Auditing County Offices

The Auditor audits other county departments to prevent misuse of funds and ensure proper financial management.

Services Offered by the Columbiana County Auditor’s Office

The Columbiana County Auditor’s Office provides essential public services including property valuation appeals through the Board of Revision, interactive mapping via the GIS Parcel Viewer, and property data in Sales Reports. It also manages Court Dockets, maintains legal documents through the Clerk of Courts, and ensures transparency by offering access to Public Records.

Board of Revision

The Board of Revision reviews property valuation appeals from property owners who believe their assessments are incorrect. It ensures fair and accurate property valuations, allowing taxpayers to contest property taxes, present evidence, and have their cases fairly evaluated in accordance with Ohio laws and county procedures.

GIS Parcel

The GIS Parcel Viewer is an interactive online mapping system that allows users to explore property information across Columbiana County. It provides details such as parcel boundaries, ownership data, and zoning classifications, assisting residents, developers, and officials in research, property planning, taxation, and local land management.

Sales Report

The Sales Report service compiles recent property sales throughout Columbiana County, including sale prices, transaction dates, and property types. This valuable data helps homeowners, assessors, and real estate professionals track local market trends, evaluate property values, and make informed decisions for buying, selling, or tax purposes

Court Docket

The Court Docket provides public access to legal cases and court proceedings involving property valuation disputes or tax-related matters. It helps citizens, attorneys, and officials stay informed about case statuses, decisions, and schedules, ensuring that the Auditor’s office operates transparently and in accordance with judicial procedures.

Clerk of Courts

The Clerk of Courts service handles the official recording and maintenance of essential county documents such as deeds, mortgages, liens, and judgments. It ensures the secure storage, easy retrieval, and public accessibility of legal property records for both individuals and professional users within Columbiana County.

Public Records

The Public Records service allows citizens to obtain property, tax, and financial records maintained by the Auditor’s office. This service upholds the principles of transparency and accountability by providing verified information that supports property research, public decision-making, and legal or governmental processes in the county.

Columbiana County Auditor Records and Taxes

Real Estate Taxes

The Auditor’s Office assesses and certifies all real estate taxes in Columbiana County. It determines property values, applies tax rates, and calculates annual tax bills. Collected taxes support schools, libraries, townships, and local services, ensuring fair distribution and proper funding for essential community operations.

Manufactured Home Taxes

The Auditor administers taxes for manufactured homes, ensuring accurate valuation and billing. Homeowners receive annual statements based on assessed property value and applicable rates. This process maintains fairness in taxation while generating revenue that contributes to vital local infrastructure, education, and community development projects within the county.

Tax Rates and Levies

The Auditor calculates tax rates and levies for various taxing districts, including schools, municipalities, and townships. These rates are based on voter-approved levies and local budgets. The Auditor ensures that all rates are applied correctly and transparently, maintaining fairness and compliance with Ohio’s tax laws.

Homestead Exemption

The Homestead Exemption program offers property tax relief to qualifying senior citizens and disabled homeowners. The Auditor’s Office manages applications, verifies eligibility, and applies tax reductions. This program helps ease the financial burden on fixed-income residents while promoting stability and affordability in homeownership across the county.

Current Agricultural Use Valuation (CAUV)

The CAUV program allows qualifying farmland to be taxed based on agricultural value rather than market value. The Auditor’s Office processes applications, maintains records, and verifies eligibility annually. This program supports farmers by reducing property tax obligations and preserving agricultural land for future generations.

Special Assessments

The Auditor administers special assessments for local improvements such as sidewalks, drainage systems, or lighting projects. These assessments are added to property tax bills and collected on behalf of municipalities or townships. The process ensures that costs for community improvements are shared fairly among benefiting property owners.

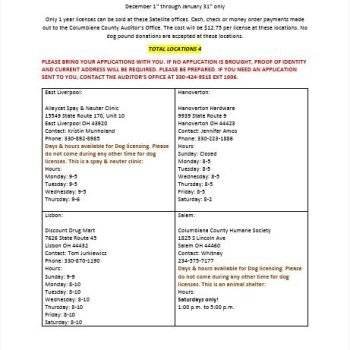

Columbiana County Dog License And Application

Obtaining a dog license through the Columbiana County Auditor ensures your pet’s proper identification, legal compliance, and community safety. A licensed dog can be returned quickly if lost, while the fees support essential local animal services. The Auditor’s online registration system is convenient, secure, and promotes responsible pet ownership.

Columbiana County Contact Details

Columbiana County Auditor Contact Information

For any questions or assistance, residents can directly contact the Columbiana County Auditor’s Office during working hours. The office is dedicated to providing reliable information and responsive support for property, tax, and public records inquiries.

Office Hours

Monday – Friday 8:00 – 4:00

Telephone: (330) 424-9515

Fax: (330) 424-9745

105 South Market Street

Lisbon, Ohio 44432

FAQs

How are property taxes calculated in columbiana County?

Property taxes in Columbiana County are calculated using 35% of your property’s market value, known as the assessed value. Local tax rates (mills) set by schools, townships, and county levies are then applied to this assessed amount. The Columbiana County Auditor ensures assessments remain fair, accurate, and regularly updated. This process provides transparency in how each property owner’s tax responsibility is determined.

Why is the Columbiana County Auditor important to residents?

The Columbiana County Auditor is important to residents because they ensure fair and accurate property assessments, manage county finances, and maintain transparency in tax collection. The auditor also oversees real estate records, distributes tax revenues to local schools and services, and protects public funds to support community development and accountability.

Does the Columbiana County Auditor handle dog licenses?

Yes! The Columbiana County Auditor’s Office handles dog licenses, making sure pets are properly registered and compliant with county laws. Licensing helps keep dogs safe, supports local animal services, and makes it easier to return lost pets to their owners.

How can I perform a property search in Columbiana County?

Residents can easily search properties in Columbiana County using the Auditor’s online . You can look up information by owner name, address, or parcel number, and access details like property values, ownership history, and tax records. This makes it simple and efficient to find accurate real estate information anytime.

Can I appeal my property valuation?

Yes. If you believe your property valuation is inaccurate, you can file an appeal with the Columbiana County Board of Revision, which reviews cases and ensures fair assessments.

What services are available online from the Columbiana County Auditor?

The Auditor’s Office provides several online services, including property searches, GIS Parcel Viewer, tax estimators, dog license applications, public records access, and more. These tools make it easy for residents to access accurate and up-to-date county information.