Columbiana County Homestead Exemption 2026

The Columbiana County Homestead Exemption provides qualifying homeowners with valuable property tax relief by reducing the taxable value of their primary residence. This program supports seniors, disabled homeowners, and eligible veterans, helping them manage property taxes more affordably. Understanding the eligibility rules, income limits, and application process ensures residents can maximize their savings. Correctly applying for the Columbiana County Homestead Exemption protects homeowners financially and promotes fairness within the county tax system.

What Is the Homestead Exemption?

The Columbiana County Homestead Exemption is a state authorized tax reduction program administered locally by the Columbiana County Auditor. It lowers the taxable value of a qualifying homeowner’s primary residence, resulting in reduced annual property taxes.

The exemption is designed to assist those who face financial challenges due to age, disability, or limited income, while ensuring equitable property taxation across the county.

Who Qualifies in Columbiana County?

Residents who may qualify for the Homestead Exemption include:

Seniors

- Homeowners aged 65 or older during the year of application.

Disabled Individuals

- Residents who are permanently and totally disabled, with verification through medical documentation or Social Security disability award letters.

Qualifying Veterans & Surviving Spouses

- Honorably discharged veterans with a 100% service connected disability rating, or

- Surviving spouses of qualifying veterans who have not remarried.

Income Based Qualification

- The state of Ohio sets an annual income limit (adjusted yearly). Applicants must fall within the required threshold.

To qualify, applicants must:

- Own and occupy the home as their primary residence on January 1 of the application year.

- Meet age, disability, or veteran criteria.

- Provide all required documentation.

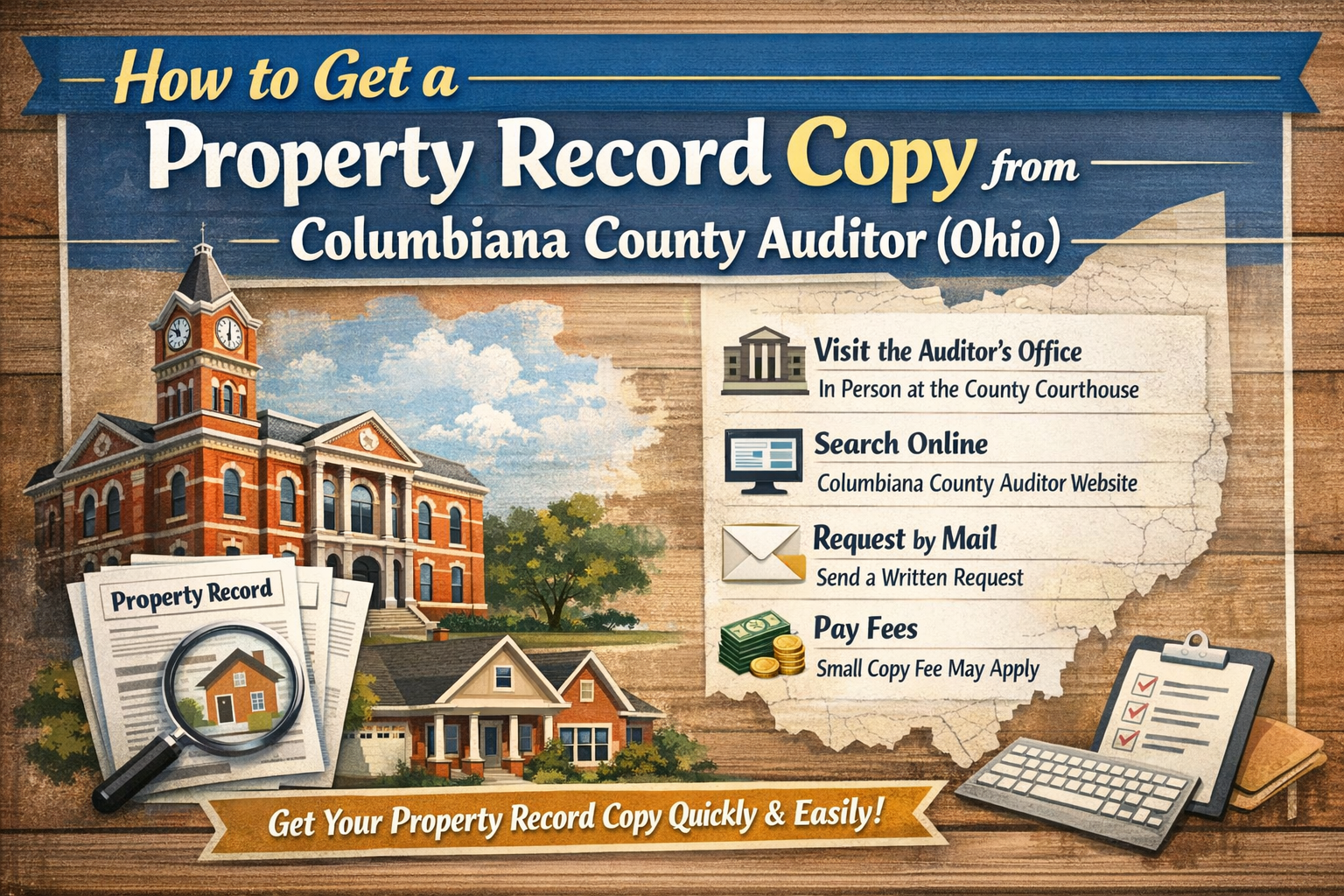

How to Apply (Columbiana County Process)

Applying for the Columbiana County Homestead Exemption involves the following steps:

1. Obtain the Official Application Form

Available from:

Columbiana County Auditor’s Office

or the Auditor’s official website (Homestead Exemption section).

2. Prepare Required Documents

Applicants must submit:

- Valid ID

- Proof of age or disability (if applicable)

- Proof of homeownership and residency

- Ohio Adjusted Gross Income documentation (if income-based)

3. Submit Your Application

You may submit:

- In person at the Columbiana County Auditor’s Office

- By mail

- Online, if the county provides digital submission options

4. Await Auditor Approval

The Auditor reviews eligibility and sends confirmation once the exemption is approved.

5. Renew When Required

Most applicants remain enrolled automatically, though changes in residency, income, or eligibility must be reported.

Benefits of the Homestead Exemption

Using the Columbiana County Homestead Exemption offers:

Reduced Taxable Value

The county reduces the assessed value of the home before taxes are calculated.

Lower Annual Property Taxes

Eligible homeowners receive a significant reduction on their yearly tax bill.

Financial Support for Seniors & Disabled Residents

The exemption helps residents remain in their homes affordably.

Ensured Fair Taxation

The program ensures those with fixed or limited income are not overburdened by rising property taxes.

Common Challenges Applicants Face

Some residents may experience:

- Missed application deadlines

- Incomplete supporting documents

- Confusion about income limits or eligibility rules

- Misunderstanding veteran disability qualifications

- Failure to notify the Auditor of changes in residency

Careful preparation helps increase the likelihood of approval.

Quick Steps to File

| Step | Action | Notes |

| 1 | Obtain Homestead Exemption application | From the Columbiana County Auditor |

| 2 | Gather required documents | ID, income proof, residency verification |

| 3 | Submit the application | In-person, by mail, or online |

| 4 | Wait for county approval | Auditor reviews eligibility |

| 5 | Renew if required | Some cases auto-renew; verify annually |

Conclusion

The Columbiana County Homestead Exemption is a vital tax relief program that helps seniors, veterans, disabled individuals, and income eligible homeowners reduce their annual property taxes. By understanding the requirements, deadlines, and submission process, residents can take full advantage of this financial benefit and maintain long-term homeownership security in Columbiana County.

FAQs

1. Who qualifies for the Columbiana County Homestead Exemption?

Seniors (65+), disabled residents, qualifying disabled veterans, and homeowners who meet state income requirements.

2. How do I apply?

Complete the official Homestead Exemption form, attach required documents, and submit it to the Columbiana County Auditor by the annual deadline.

3. What benefits does the exemption provide?

It lowers the taxable value of your home, reducing your yearly property tax bill.

4. What happens if I miss the deadline?

Missing the filing deadline can delay your exemption until the next tax year.

5. Do I need to reapply every year?

Some applicants stay enrolled automatically, but changes in income, residency, or eligibility must be reported.

Post Comment