Columbiana County Legal Division Information & Forms (2026 Guide)

Navigating government documents can feel overwhelming, but the Columbiana County Auditor’s Office makes it easier with centralized access to essential forms, legal documents, property records, and tax-related information. Whether you’re filing a property value complaint, requesting tax data, or downloading official auditor forms, this comprehensive guide provides clear, step-by-step direction to help you move through the process with confidence and accuracy.Understanding which forms you need to learning how to submit them correctly, this resource ensures that residents, property owners, and businesses can efficiently handle their administrative and legal requirements under the Columbiana County Auditor’s Office.

Step 1: Identify What You Need from the Auditor’s Office

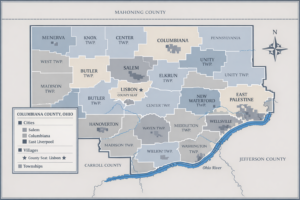

Before downloading or submitting any form, confirm which category your request falls under. The Auditor handles:

Common Requests in Columbiana County

- Property value complaints

- Real estate tax information

- Ownership change forms

- Homestead exemption applications

- CAUV agricultural forms

- Property transfers

- Dog license lookup

- GIS/parcel maps

- Public financial records

- Manufactured home forms

Once you know your category, you can select the correct form and follow the right process.

Tip: Many forms require parcel numbers. You can search parcels through the Auditor’s property search tool.

Step 2: Find and Download the Correct Form

Where to Access Forms

Visit the official Columbiana County Auditor Forms Page.

What You Need To Do

- Select the category (Real Estate, Tax, CAUV, Homestead, Manufactured Home, etc.)

- Choose the specific form you need

- Open the PDF and review the instructions carefully

Important Reminders

- Always use the latest version of each form

- Some forms require supporting documents (ID, deed copy, tax bill, etc.)

Step 3: Fill Out the Form Correctly

Mistakes here often lead to delays. Use this checklist:

How To Fill Forms Properly

- Use your full legal name (as per deed or tax record)

- Enter the correct parcel number

- List accurate property address

- Attach required documents (ID, deed copy, income proof, photos, etc.)

- Sign all required fields

- If appealing property value, provide evidence (comparables, photos, appraisals)

Avoid These Mistakes

- Leaving mandatory fields blank

- Incorrect parcel number

- Missing signatures

- No supporting documents

- Not checking fee requirements

Step 4: Submit or File Your Forms

You can file Auditor related forms in person or by mail (some may allow email depending on form type).

Filing In Person

Columbiana County Auditor’s Office

105 South Market Street

Lisbon, OH 44432

The staff will review your form, stamp it, and guide you on next steps.

Filing by Mail

Mail your completed form + copies to the same address.

Include:

- All required documents

- Return envelope (if you need documents mailed back)

Step 5: Request Certified Copies or Public Records

If you need certified tax records, property documents, or valuation notices, follow these steps:

What To Do

- Fill out the Public Records Request Form

- Enter parcel, owner, or tax year information

- Pay certification/copy fees

- Choose pick-up or mail delivery

Typical requests include:

- Tax history

- Valuation changes

- Property transfer records

- CAUV enrollment history

- Dog license reports

Step 6: Contact the Columbiana County Auditor

If you need clarification about a form, fee, or filing process, contact the Auditor directly.

Columbiana County Auditor Contact

📍 Address:

105 South Market Street

Lisbon, OH 44432

📞 Phone: 330-424-9515

📠 Fax: 330-424-9467

You can ask about:

- Form requirements

- Property value complaint process

- CAUV or Homestead eligibility

- Public records

- Real estate tax questions

- Parcel lookup issues

Conclusion

This guide gives you a complete overview of accessing forms, filing documents, and requesting records from the Columbiana County Auditor.

If you follow each step carefully, your submission will be accurate, complete, and processed without delays.

FAQs

1. Can I file a property value complaint without an attorney?

Yes, homeowners may file on their own with supporting evidence.

2. How long does the Auditor take to process filings?

Most submissions are reviewed within standard business timelines. Value complaints follow tax-year deadlines

3. Do I need the latest version of the form?

Absolutely—older forms may be rejected.

4. Can I request property records by mail?

Yes. Include payment and a return envelope.

5. What if I don’t know my parcel number?

You can search using owner name or address on the Auditor’s website.

Post Comment