File a Property Value Complaint in Columbiana County

Property values play a major role in determining how much homeowners pay in annual property taxes. If you believe your home, land, or commercial property in Columbiana County has been overvalued or inaccurately assessed you have the right to file a property value complaint. This formal process ensures that all property owners are treated fairly and that county assessments reflect true market conditions. Here is a complete guide to help you understand when, why, and how to file a complaint with the Columbiana County Board of Revision.

1. What Is a Property Value Complaint?

A property value complaint is a formal request asking the county to review and potentially adjust your property’s assessed value.

This complaint is not about tax rates but strictly about whether your property’s assessed market value is accurate.

Common reasons for filing include:

- Your assessed value is higher than recent home sales in your area

- Your property has structural issues not reflected in the assessment

- Your home has suffered damage (foundation, roof, flooding, etc.)

- Comparable neighborhood properties are valued lower

- Major renovations or additions were incorrectly recorded by the county

If any of these apply, filing a complaint may help reduce your annual tax bill.

2. Which Office Handles Property Value Complaints?

In Columbiana County, all property value complaints must be filed with the:

Columbiana County Board of Revision (BOR)

The BOR is a three-member board that reviews evidence, holds hearings, and makes decisions on valuation disputes.

The Auditor’s Office assists in processing but does not make the final decision during a BOR case.

3. When Can You File a Complaint?

Ohio law allows property owners to file one complaint per property per tax year.

Filing Period:

January 1 – March 31

This is a strict deadline. Complaints received after March 31 cannot be processed for that tax year.

4. How to File a Property Value Complaint

Filing a complaint involves completing the official DTE Form 1 and submitting it to the BOR.

Step-by-Step Process

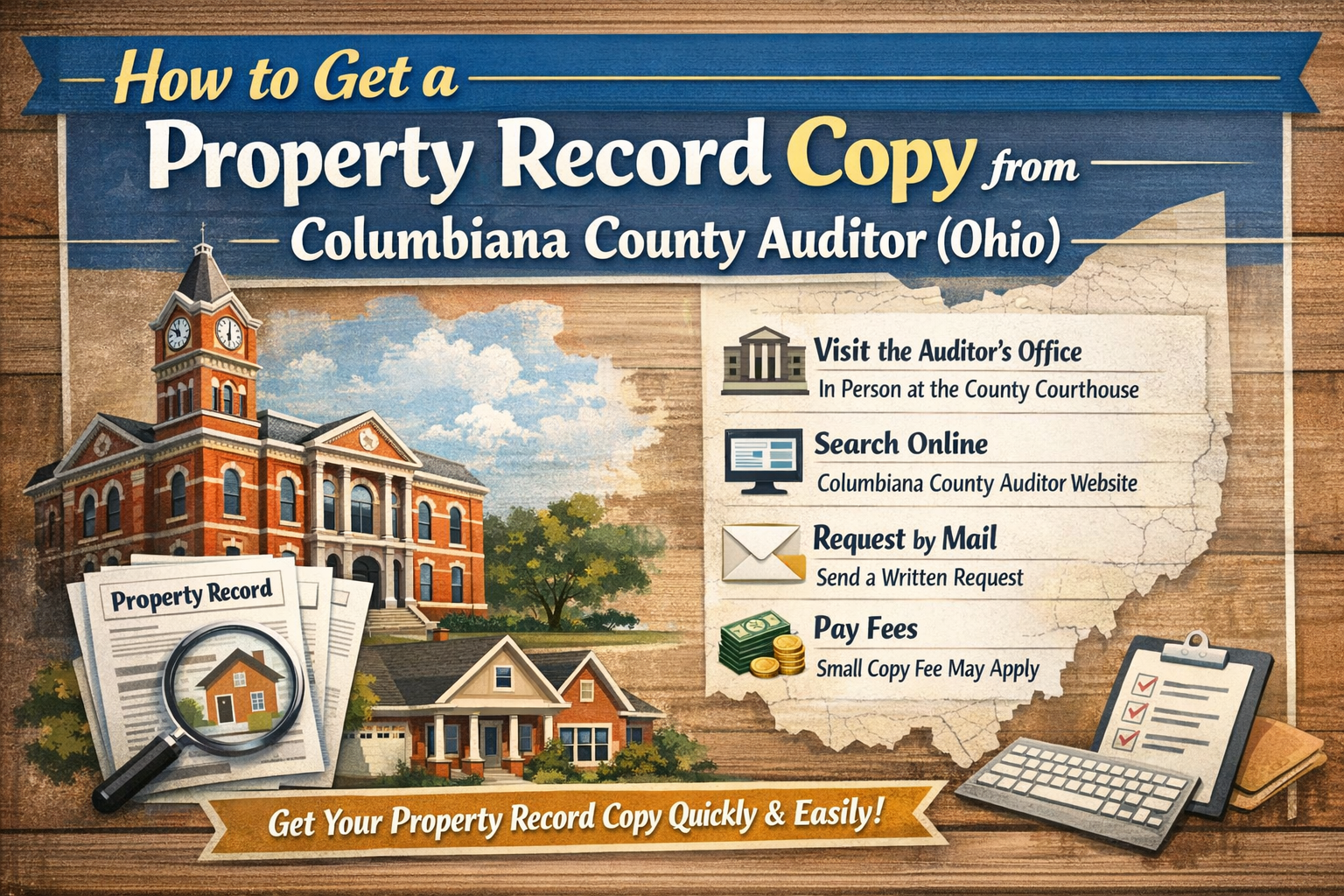

Step 1: Download or Obtain the DTE Form 1

You can get the form:

- On the Columbiana County Auditor’s website

- By visiting the Auditor’s Office in person

- By requesting it through mail

Step 2: Complete the Form Carefully

The form requires detailed information such as:

- Property owner name

- Parcel number

- Property address

- Current assessed value

- Your requested value

- Reason for complaint

- Any supporting explanations

Step 3: Gather Supporting Evidence

Strong evidence increases your chances of a successful valuation change. Examples include:

- Recent professional appraisal

- Photos of property damage or deterioration

- Contractor estimates for repairs

- Comparable property sales (comparables)

- Market analysis from a real estate professional

- Insurance claim or inspection reports

Step 4: Submit the Complaint

You can file your complaint:

- In person at the Auditor’s Office

- By mail (must be postmarked by March 31)

Keep a copy of everything for your records.

5. What Happens After You File?

After your complaint is submitted:

1. The BOR Reviews Your Application

They will check for completeness and confirm eligibility.

2. A Hearing Will Be Scheduled

You’ll receive a notice with your hearing date and time.

Hearings are typically held during spring and summer.

3. Prepare for the Hearing

At the hearing, you will present your case and evidence. Bring:

- Printed documents

- Photos

- Appraisals

- Comparables

- Any witnesses or professionals (optional)

The BOR may ask questions about property condition, value changes, or your supporting documents.

4. BOR Issues a Decision

After reviewing your evidence and any county input, the Board will issue a written decision.

This decision may:

- Reduce your property value

- Keep it the same

- Increase it (rare but possible if data supports it)

6. If You Disagree with the Board’s Decision

You have the right to appeal the BOR decision.

Appeal Options:

- Ohio Board of Tax Appeals

- Columbiana County Court of Common Pleas

Appeals must be filed within the deadline listed in your decision letter.

7. Tips for a Successful Property Value Complaint

- Provide solid, documented evidence the Board relies heavily on proof.

- Avoid emotional arguments stick to facts, numbers, and photos.

- Use recent comparable sales preferably from the past 12–18 months.

- If damage exists, document it clearly include estimates or professional reports.

- Professional appraisals are very strong evidence, especially if recent.

Being organized and clear increases the likelihood of a fair valuation adjustment.

Conclusion

Filing a property value complaint in Columbiana County is a straightforward process designed to protect homeowners and ensure fair taxation. Between January 1 and March 31, property owners can submit a DTE Form 1, present evidence, and attend a hearing before the Board of Revision. With strong documentation such as appraisals, photos, or comparable sales you can challenge inaccurate assessments and potentially lower your property tax burden. The system is transparent, accessible, and structured to give every homeowner the opportunity for an accurate and fair property valuation.

FAQs

1. What is the deadline to file a property value complaint?

You must file between January 1 and March 31 for the current tax year.

2. Which form do I need to submit?

You must use the DTE Form 1, the official complaint form required statewide in Ohio.

3. Do I need an attorney to file a complaint?

No, but you may hire one if you prefer professional representation.

4. Can filing a complaint increase my property value?

Yes, although rare, the Board of Revision can raise your value if evidence supports it.

5. What evidence is most effective?

Professional appraisals, comparable sales, and clear documentation of property damage are the strongest forms of evidence.

6. How long does the process take?

Hearings usually take place in spring or summer, and decisions follow within several weeks.

7. Can I appeal the BOR’s decision?

Yes. Appeals can be made to the Ohio Board of Tax Appeals or the Columbiana County Court of Common Pleas.

Post Comment