How to Appeal Property Tax Valuation in Columbiana County

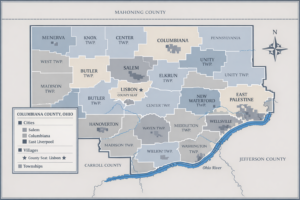

If you believe your property in Columbiana County has been overvalued, you have the legal right to appeal. A successful appeal can reduce your tax burden and ensure you pay only your fair share. This guide explains who can appeal, why appeals may be necessary, and step-by-step instructions for filing a property tax valuation appeal in Columbiana County.

Why You Might Need to Appeal Your Property Valuation

Property valuations can sometimes be higher than they should due to market changes, incorrect property data, or unrecorded damage. When this happens, your property taxes may increase unnecessarily.

Common reasons to appeal include:

- Incorrect square footage or building details

- Unaccounted property damage

- Recent sale prices lower than assessed value

- Comparable homes in the area valued much lower

- Market conditions not reflected in the valuation

Step-by-Step Guide: How to Appeal Property Tax Valuation in Columbiana County

Following the correct process increases your chances of a successful appeal. Here’s how to proceed:

Step 1: Review Your Property Valuation Notice

The Columbiana County Auditor sends every property owner a valuation notice, which includes:

- Appraised value

- Assessed value

- Property details

- Auditor contact information

Check for errors or discrepancies sometimes even small mistakes can affect your taxes.

Step 2: Gather Evidence to Support Your Claim

Strong supporting documents are essential for a successful appeal. Useful evidence may include:

- A recent independent appraisal

- Photos showing property damage or necessary repairs

- Recent comparable sales of similar homes at lower prices

- Contractor estimates for significant repairs

- Documents highlighting errors in square footage or property details

Tip: The more professional and detailed your evidence, the higher your chance of success.

Step 3: Complete the Official Appeal Form

All property tax appeals in Columbiana County must be filed with the Board of Revision (BOR).

- Form to use: DTE Form 1 – Complaint Against the Valuation of Real Property

- Include all supporting evidence with your submission

Important deadline: Appeals must be filed between January 1 and March 31 each year. Late submissions are usually not accepted.

Step 4: Submit Your Appeal

You can submit your appeal in one of three ways:

- Online (Fastest)

Visit the official Columbiana County Auditor website and submit the digital form. - By Mail

Mail the completed DTE Form 1 and supporting documents to:

Columbiana County Board of Revision

[Insert mailing address from official site] - In Person

Deliver documents directly to the Auditor’s Office at the Columbiana County Administration Building.

Step 5: Attend the Board of Revision Hearing

After submission, the BOR schedules a hearing where you can:

- Present evidence supporting your appeal

- Explain why your property is overvalued

- Answer any questions from the Board

Hearings usually last 15–20 minutes. Be clear, factual, and organized.

Step 6: Wait for the Final Decision

The Board reviews all evidence and mails the decision to you. This process may take several weeks.

If approved, your property value and therefore your taxes—will be reduced. If denied, you may appeal further to:

- The Ohio Board of Tax Appeals, or

- The Columbiana County Court of Common Pleas

Tips for a Successful Appeal

- Use professional appraisals or contractor reports

- Present recent comparable sales close to the valuation date

- Highlight clear discrepancies in property details

- Stay organized, polite, and factual during the hearing

- Submit your appeal before March 31

Conclusion

Appealing your property tax valuation in Columbiana County is straightforward if you follow the correct steps and provide strong evidence. Properly filing an appeal can ensure fairness, protect your financial interests, and potentially save you money each year.

FAQs

Q1: Is there a fee to file a property tax appeal?

No, filing with the Board of Revision is free.

Q2: What happens if I miss the March 31 deadline?

Your appeal will not be accepted. You must wait until the next tax year.

Q3: Do I need an attorney to file an appeal?

No, but an attorney can help in complex cases or commercial property disputes.

Q4: Can my property value increase after an appeal?

Rarely, but it is possible. The Board reviews the property fully.

Q5: How long does the appeal process take?

Most cases are resolved within 1–3 months, depending on hearing schedules and appeal volume.

Post Comment