Columbiana County Property Tax: Complete Guide

Property taxes are an important responsibility for homeowners and real estate investors in Columbiana County, Ohio. Understanding how property taxes are assessed, calculated, and paid can help residents plan their finances, avoid penalties, and take advantage of available exemptions. The Columbiana County Auditor and Treasurer work together to ensure fair valuation, collection, and distribution of property taxes. This guide explains the property tax process, important deadlines, payment options, and tips for managing your property tax obligations efficiently.

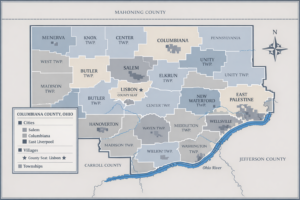

1. Understanding Property Taxes in Columbiana County

Property taxes are a local tax based on the assessed value of real estate, including residential, commercial, and agricultural properties. These taxes fund local schools, infrastructure, emergency services, and other county programs.

The Columbiana County Auditor determines the assessed value of properties, while the Treasurer is responsible for collecting taxes and managing payments.

2. How Property Taxes Are Calculated

Property taxes are calculated using the following steps:

- Determine Assessed Value: The Auditor assesses each property at 35% of its true market value as mandated by Ohio law.

- Apply Tax Rate: The local tax rate, also known as millage, is set by county authorities, schools, and municipalities.

- Calculate Tax Amount:

Assessed Value × Tax Rate = Annual Property Tax

This means higher property values or higher tax rates result in higher taxes, while exemptions or reductions may lower your bill.

3. Property Tax Payment Schedule

Columbiana County property taxes are typically paid semi-annually:

- First Half: Due January 20

- Second Half: Due July 20

Payments received after the due date may incur penalties and interest. The Treasurer’s Office provides reminders and official bills to all property owners.

4. How to Pay Property Taxes

Columbiana County offers multiple convenient ways to pay property taxes:

Online Payments

The Treasurer’s website allows homeowners to pay using debit or credit cards, or electronic checks. Online payment is secure and provides instant confirmation.

In-Person Payments

Payments can be made at the Treasurer’s Office in the courthouse using cash, check, or card.

By Mail

Mail a check or money order to the Treasurer’s Office with your property tax bill stub. Always include proper identification to ensure your payment is credited correctly.

Through Banks or Payment Agents

Certain banks may accept property tax payments on behalf of the county. Confirm with the Treasurer’s Office which banks participate.

5. Property Tax Exemptions and Reductions

Columbiana County offers several exemptions to reduce taxable value for eligible residents:

- Homestead Exemption: Available for seniors (65+) or permanently disabled homeowners. Reduces taxable value on a portion of the home.

- Current Agricultural Use Value (CAUV): For farmland, taxes are based on agricultural productivity rather than market value.

- Nonprofit/Charitable Exemptions: Qualifying organizations may be exempt from property taxes.

Homeowners should contact the Auditor’s Office to verify eligibility and apply for exemptions on time.

6. Property Tax Appeals

If you believe your property is overvalued, you have the right to file a complaint:

- File a property value complaint with the Columbiana County Board of Revision (BOR) between January 1 and March 31.

- Provide supporting evidence such as professional appraisals, photos, or comparable sales.

- Attend a hearing to present your case.

- BOR decisions can be further appealed to the Ohio Board of Tax Appeals or Common Pleas Court.

Appealing property values can potentially reduce your annual tax burden.

7. Consequences of Late Payments

Failing to pay property taxes on time may lead to:

- Penalties and interest on overdue amounts

- Tax lien filings against your property

- Potential foreclosure if taxes remain unpaid for an extended period

Always pay before the due date or contact the Treasurer to discuss payment arrangements if needed.

8. Tips for Managing Your Property Taxes

- Verify Assessed Value: Regularly review your property assessment with the Auditor to ensure accuracy.

- Mark Payment Deadlines: Note January 20 and July 20 as key due dates.

- Check for Exemptions: Apply for all eligible reductions to lower your tax bill.

- Keep Records: Maintain receipts, confirmations, and official tax bills for your records.

- Contact Officials for Help: Auditor and Treasurer staff are available for guidance on assessments, payments, and exemptions.

Summary

Property taxes in Columbiana County are essential for funding local services and infrastructure. Taxes are based on assessed property values, calculated with state-mandated formulas, and paid semi-annually. Residents can pay online, in person, or by mail and may qualify for exemptions that reduce taxable value. Understanding the assessment, payment schedule, and appeal processes ensures homeowners comply with legal requirements while minimizing their financial burden.

1. How is my property tax calculated in Columbiana County?

Taxes are based on 35% of your property’s market value multiplied by local millage rates.

2. When are property taxes due?

Semi-annual payments are due January 20 and July 20.

3. How can I pay my property taxes?

Payments can be made online, in person, by mail, or through participating banks.

4. Are there property tax exemptions?

Yes. Exemptions include the Homestead Exemption, CAUV for farmland, and nonprofit/charitable exemptions.

5. Can I appeal my property assessment?

Yes. File a complaint with the Board of Revision between January 1 and March 31 and provide supporting evidence.

6. What happens if I pay late?

Late payments incur penalties, interest, and may eventually lead to tax liens or foreclosure.

7. Who do I contact for help?

The Columbiana County Auditor handles assessments, and the Treasurer handles payments. Both offices assist residents with questions or concerns.

Post Comment